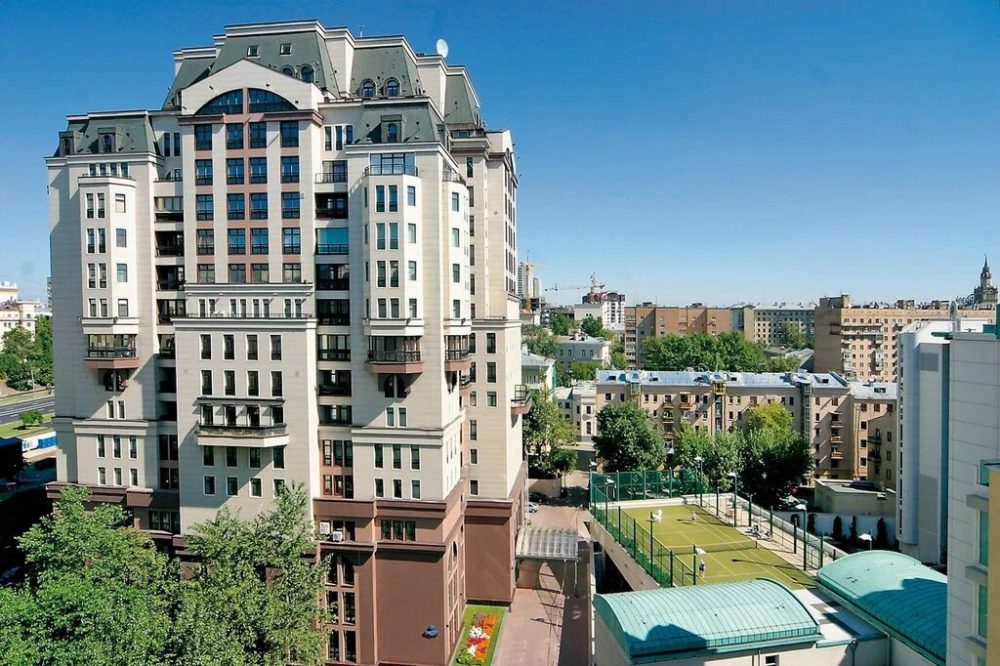

Mortgages in Russia for foreigners are no longer an exception. Banks have begun to consider applicants without Russian citizenship as solvent clients. Foreign investors, labour migrants, businessmen and residence permit recipients are entering the residential real estate market using credit mechanisms. Interest stipulates not only the need for housing, but also the strategy of capital formation, income generation and securing legal status in the country.

The procedure requires precision, but provides access to a stable property market with predictable rates, a wide range of properties and the possibility of long-term ownership. If the conditions are met, the registration is subject to the same laws as for residents. The difference is in the details.

Legal prerequisites and restrictions on mortgage registration in Russia for foreigners

Mortgages in Russia for foreigners are subject to the law. The law allows foreign individuals to own real estate, except for plots in border and strategically protected areas. The main restriction is that the lack of Russian citizenship does not entitle to purchase agricultural land and real estate in closed military regions.

Banks are more willing to grant housing loans to foreigners who:

-

reside in the territory of the Russian Federation for more than one year;

-

work under a formal contract;

-

get paid into a bank account;

-

have a residence permit or temporary residence permit;

-

have documented income;

-

made a down payment of 30% or more.

The law does not prohibit granting a loan to a foreign citizen without a residence permit, but in this case banks require additional guarantees – income certificates, surety, long-term rental agreement, registration.

Terms of granting: rates, terms, instalment

Mortgages in Russia for foreigners are issued at the same rates as for Russian citizens. The range starts from 10.5% and goes up to 25%, depending on the institution, the currency of the loan, the category of the borrower and the property. Life insurance and collateral reduces the rate to 1-2%. The standard term is from 5 to 25 years.

Mortgages in Russia for foreigners are issued at the same rates as for Russian citizens. The range starts from 10.5% and goes up to 25%, depending on the institution, the currency of the loan, the category of the borrower and the property. Life insurance and collateral reduces the rate to 1-2%. The standard term is from 5 to 25 years.

Down payment varies from 20 % to 50 %, depending on:

-

the legal status of the applicant;

-

of having a residence permit;

-

length of service in the Russian Federation;

-

income stability.

Loans for housing in new buildings and secondary housing are granted with a mandatory pledge of the purchased object. In case of refusal to insure, the rate increases by 2-3 p.p.

Document package: accuracy without margin for error

Documents for a mortgage to a foreigner in Russia are formed by the bank at the stage of preliminary consideration of the application. The standard set includes:

-

passport of a foreign citizen with a notarised translation;

-

migration card;

-

temporary registration at the place of stay;

-

residence permit or residence permit (if available);

-

a certificate of income for the last 6-12 months;

-

employment contract and a copy of the employment record book;

-

a bank statement;

-

property documents;

-

spousal consent (if married).

Russian banks verify the authenticity of all paperwork through internal compliance control services. Non-compliance or absence of at least one document is grounds for refusal.

Main reasons for refusals: what to look out for

In order for a mortgage in Russia for foreigners to go smoothly, it is important to consider the frequent reasons for refusal:

-

Lack of confirmed income in the Russian Federation.

-

Insufficient length of stay in the country.

-

Non-compliance of the selected object with the bank’s conditions.

-

Errors in documents or translations.

-

Low credit rating in other countries.

-

Lack of a registration address in Russia.

-

Insufficient down payment.

Buying without citizenship: how to circumvent restrictions

Mortgages in Russia for foreigners remain available even without citizenship. Banks allow the purchase of property in apartment buildings in territories other than border or strategic sites. In this case, it is required to comply with a number of conditions.

The client must confirm legal residence in the Russian Federation, the availability of income and employment. Most institutions require a residence permit or a residence permit, but in the presence of a good credit history and a high level of income, some credit institutions provide a mortgage and without them – subject to an increased down payment (from 40%) and the loan term of not more than 15 years. The transaction is formalised through a notary with the obligatory translation of the sale and purchase agreement and the loan agreement. Within 30 days after registration of the property, the migration authorities must be notified.

Property options and investor risks

Mortgage in Russia for foreigners covers the purchase:

-

flats in new buildings;

-

of objects on the secondary market;

-

of the apartment;

-

commercial property (limited);

-

residential houses (without agricultural land).

The process is accompanied by risks: changes in the ruble exchange rate, changes in interest rates, devaluation of collateral, increased tax burden on foreigners, changes in legislation. The investor takes these parameters into account at the stage of analysing profitability.

Processing steps: details of the procedure

A mortgage in Russia for foreigners follows a universal algorithm. Registration includes 6 stages, including:

-

Preliminary consultation at the bank. The candidate provides brief information: country of citizenship, status, desired amount, property. The bank makes a preliminary decision.

-

Collection and submission of documents. The client prepares a package of documents with notarised translations. Obligatory – proof of income, registration, certificate of employment.

-

Valuation of real estate and agreement of terms. The Bank sends an independent appraiser to the property. Based on the report, a mortgage agreement is formed and the amount of the mortgage is determined.

-

Signing of the contract. The transaction is formalised in the presence of a notary. The bank transfers funds to the seller. The client receives the keys after registration at the Rosreestr.

-

Registration of title and pledge. Rosreestr formalises the transfer of title, the bank receives the mortgage. The owner receives a certificate.

-

Payment Period. The borrower pays the loan monthly. Early repayment is possible without penalties upon 30 days’ notice to the bank.

Banks and trends: who lends to foreigners

Mortgages in Russia for foreigners are formed on the basis of the institutions’ internal policies. List of banks loyal to non-residents:

Each organisation has individual requirements for the borrower’s status, length of stay, documents, income level. Recently, banks have expanded their product lines aimed at investors, including mortgages without a 2-NDFL certificate, taking into account foreign income, secured by an existing property.

Conclusion

Mortgages in Russia are no longer exotic for foreigners. Banks are willing to work willingly with verified clients from abroad, while at the same time making high demands on documents and transparency of income. To enter the market, it is important to follow the algorithm, select an object with legal purity and calculate the full financial burden. Buying property through a mortgage remains not only a way of living, but also an effective form of investment. With the right strategy and careful approach, a foreign borrower gains access to one of the most stable property markets in the region.

Mortgages in Russia are no longer exotic for foreigners. Banks are willing to work willingly with verified clients from abroad, while at the same time making high demands on documents and transparency of income. To enter the market, it is important to follow the algorithm, select an object with legal purity and calculate the full financial burden. Buying property through a mortgage remains not only a way of living, but also an effective form of investment. With the right strategy and careful approach, a foreign borrower gains access to one of the most stable property markets in the region.

en

en  ru

ru  de

de  ar

ar  es

es  nl

nl  hi

hi  fr

fr  it

it  pt

pt  el

el